Updated Models & Spotlight Chart 11/17/2024

Equities Pullback with One Sector at Risk of Losing Relative Performance

The S&P 500 fell -2% last week with sector leadership coming from XLF, XLE, and XLU. Not a big shift in rotation to defensive sectors with only one making the top three but bears still couldn’t shake financial stocks on the week. The ratio of Buying and Selling Pressure flipped negative at the end of last week, having an impact on the Maestro Trend Score. Momentum went lower as a Hinden erg Omen was registered for the S&P 500. While the S&P 500 gapped lower on Friday, 66% of stocks did outperform and there were less than 70% of large cap stocks that declining on the day. The decline was led by smaller cap stocks, with Micro Caps now down -7.9%, Small -4.47%, Mid -3.65%, and Large -2.2%. The Spotlight Chart this week’s looks at one sector that could see a reversal in its relative performance going forward, with details below.

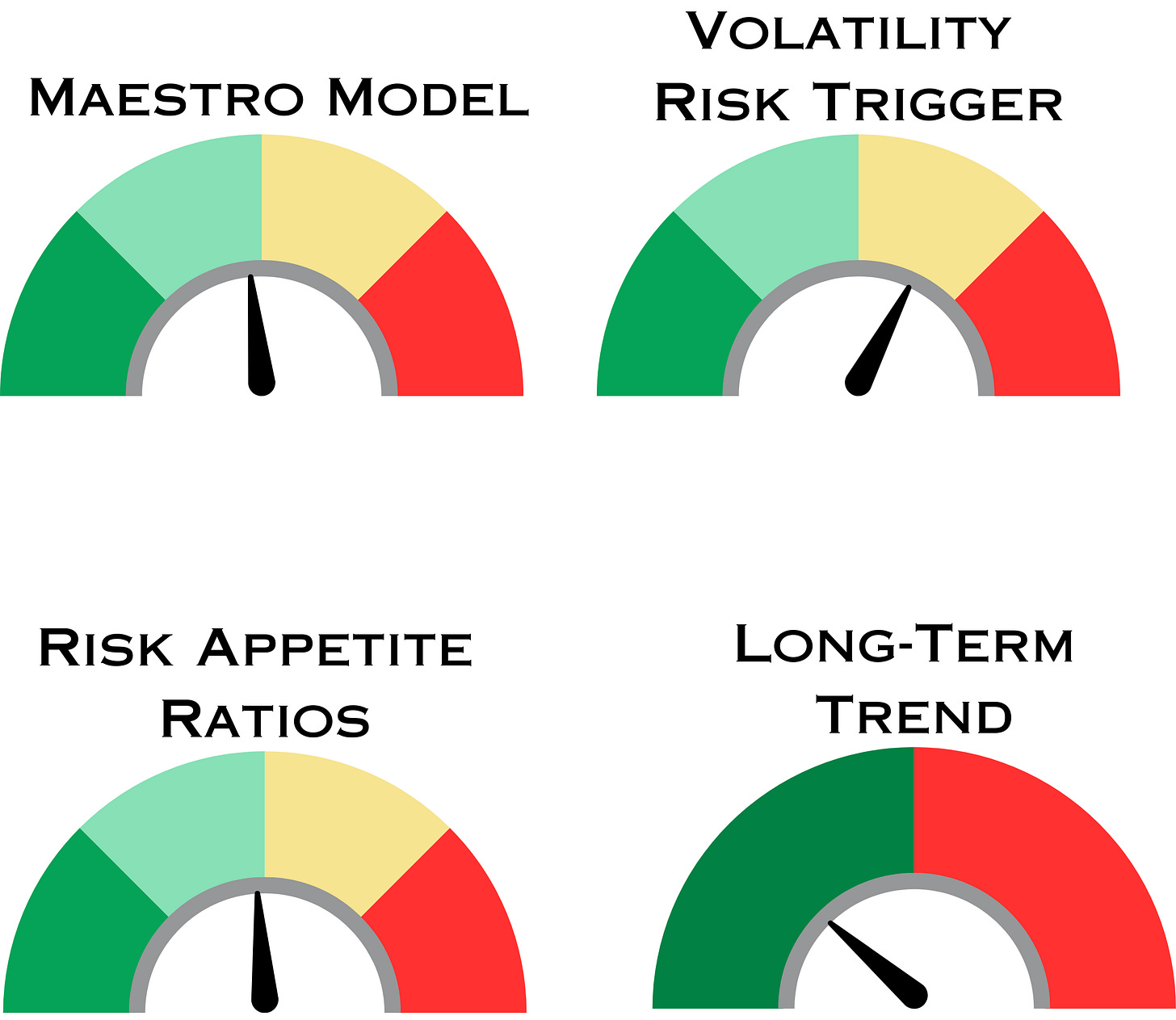

Summary of Models

Keep reading with a 7-day free trial

Subscribe to Thrasher Analytics to keep reading this post and get 7 days of free access to the full post archives.