Updated Models & Spotlight Chart 6/22/2025

Leaders Hit Key Level and One Sector May Get a Bounce

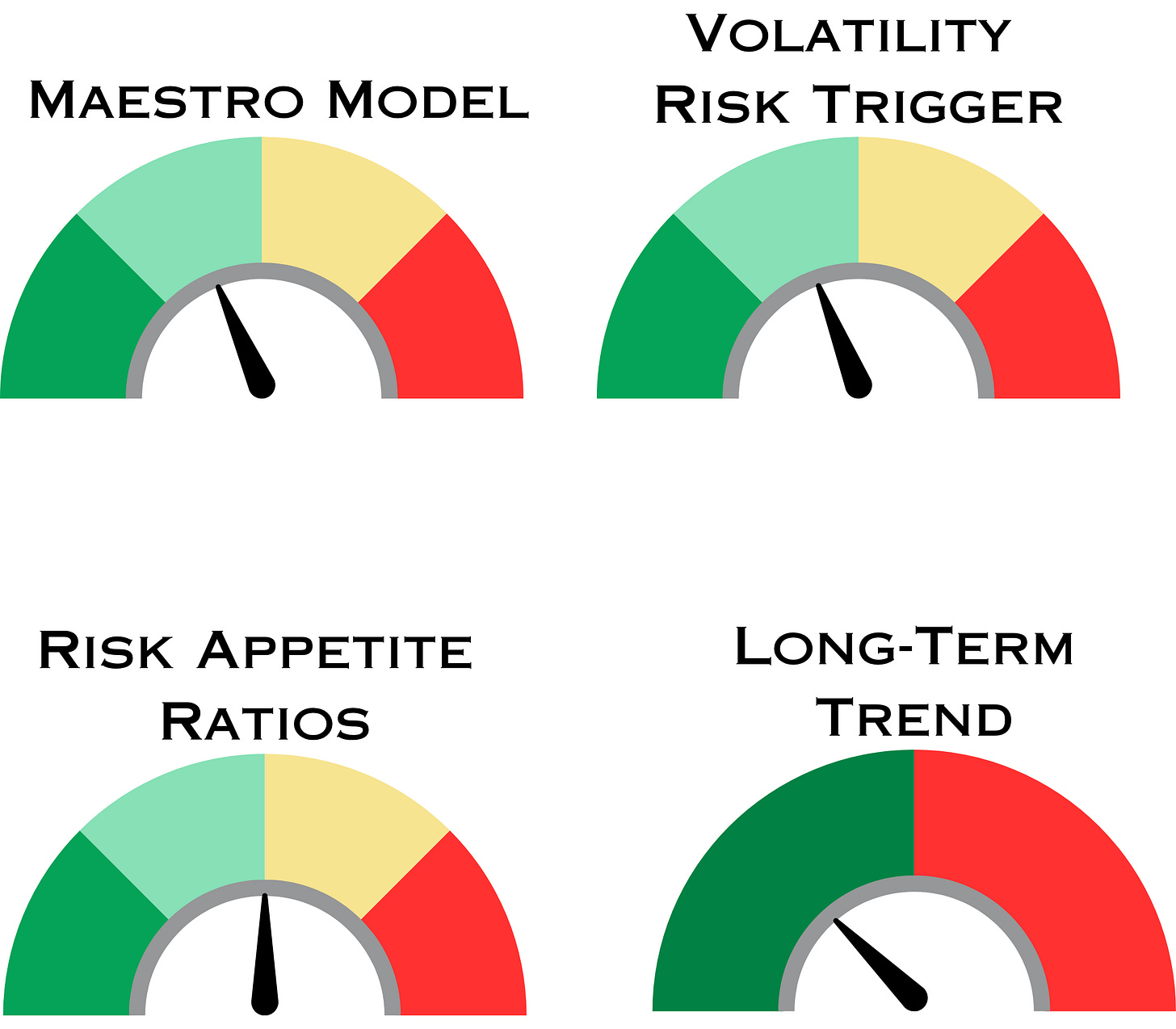

The S&P 500 fell for a second week, declining by a minimal -0.15% with the strongest sectors being XLE, XLF, and XLK. The Maestro Model is still positive but did lose eight points by Friday. Leadership for equities is at a critical level and in the first Spotlight Chart I discuss why a breakout without the help of major plays would be bullish, but it needs to happen first. The second Spotlight Chart looks at one sector that could see a reversal in relative strength soon. This all transpires while major headlines continue to infiltrate markets. This time it’s the news of the U.S. bombing Iran as the world waits what response (if any) Iran now has. Thankfully as a technician I focus my attention on price and not headlines and allow the market to dictate what it deems important.

Summary of Models

Index & Sector Performance Summary

Volatility Risk Trigger

VRT remains at 48, still below the threshold for a signal.

Keep reading with a 7-day free trial

Subscribe to Thrasher Analytics to keep reading this post and get 7 days of free access to the full post archives.