Updated Models & Spotlight Chart 12/8/2024

Just 4 Stocks Mattered Last Week With VIX Data Becoming Concerning

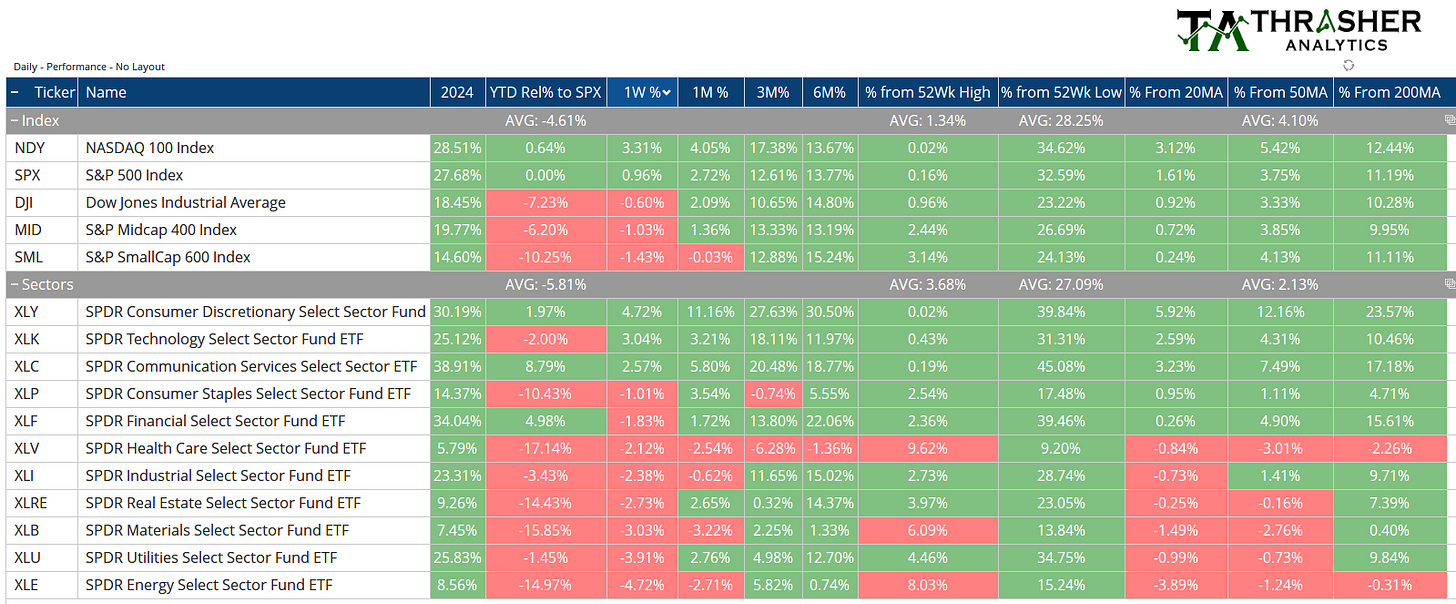

The S&P 500 finished the week up about 1% led by XLY, XLC, and XLY. The most notable development on the week was the drop in breadth. We didn’t have a day of more than half of stocks outperforming the Index and despite the new high in the SPX, most stocks are under their 20-day moving average. I’ll cover these charts in the Breadth Update later this week. Looking at performance attribution (how much east stock contributed the return of the Index). AMZN, MSFT, TSLA, and NVDA, which account for 19% of the S&P 500, contributed 113% of the return. This means these four names alone accounted for more than all other stocks combined for the SPX to be up 1% on the week. Amazon and Microsoft alone accounted for over 60% of the weekly gain.

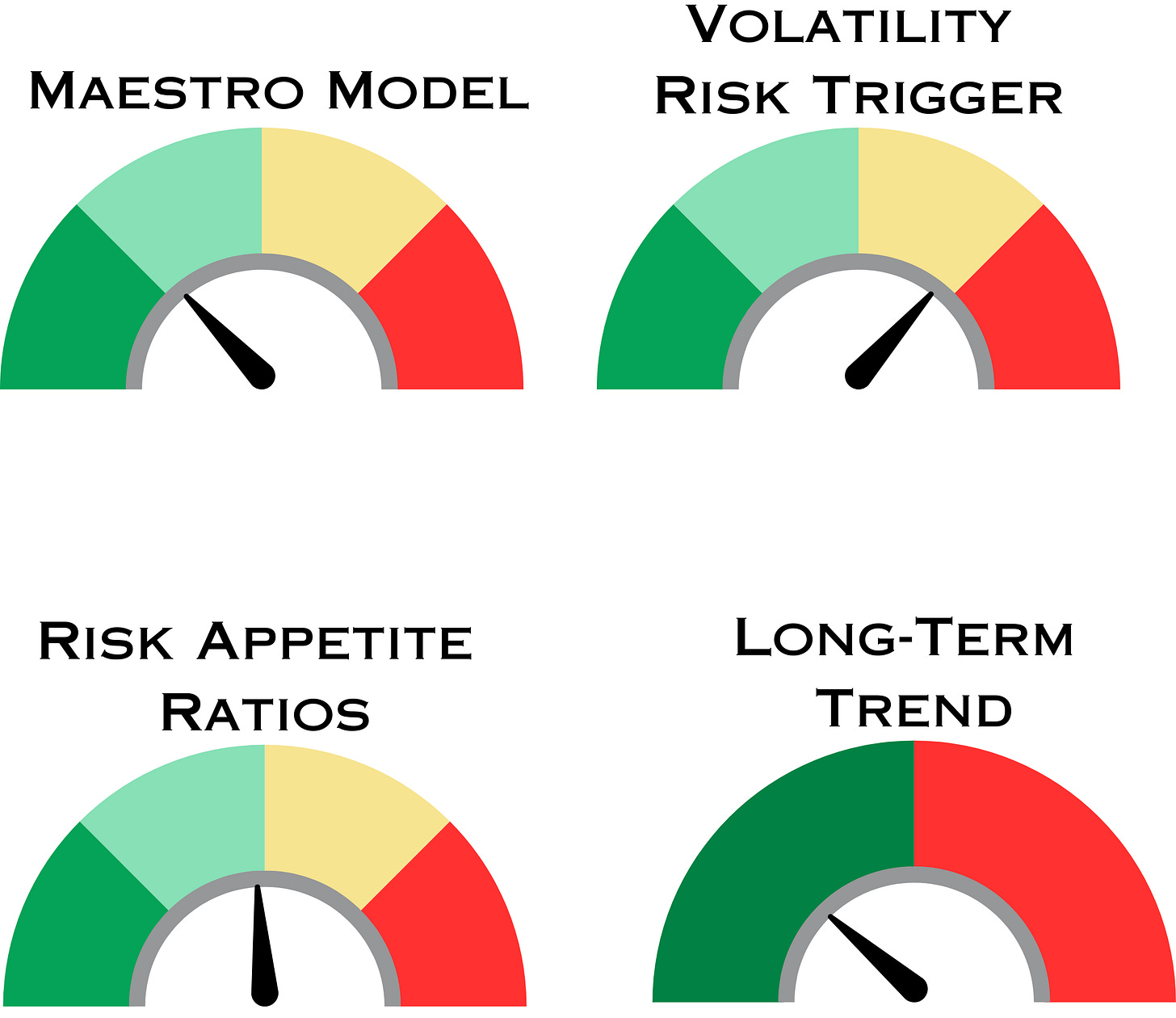

Risk Appetite didn’t change on the week and Maestro Model has a new Aggressive signal. Seasonality suggests stocks should do well into the year and based on the changes in volatility data, that’s getting heavily priced in the market right now.

Summary of Models

Index & Sector Performance Summary

Keep reading with a 7-day free trial

Subscribe to Thrasher Analytics to keep reading this post and get 7 days of free access to the full post archives.