A big week for data reporting this week. Not only do we get an update from the Fed on Wednesday, with the market expecting a 25-point cut but five of the seven largest stocks in the world report earnings this week. This will be a heavy week for earning. On Tuesday we’ll get UPS, V, and PYPL. Weds. has CAT, MSFT, META, and GOOGL. Thursday we’ll get reports from AMZN, AAPL, MA, and LLY and finally on Friday earnings from XOM and CVX. Most of these mega cap names are trading near their highs, suggesting the market isn’t expecting disappointment in their reports. We’ll see if they can deliver.

Last week spotlight chart looked at Silver, with two bearish divergences in the chart I was watching. This was then followed by one of the largest single day declines in silver prices in the last decade and Silver being down now over -10% following a new all-time high just the Thursday before. This week’s spotlight charts look at another commodity chart as well as relative performance for sectors and factors.

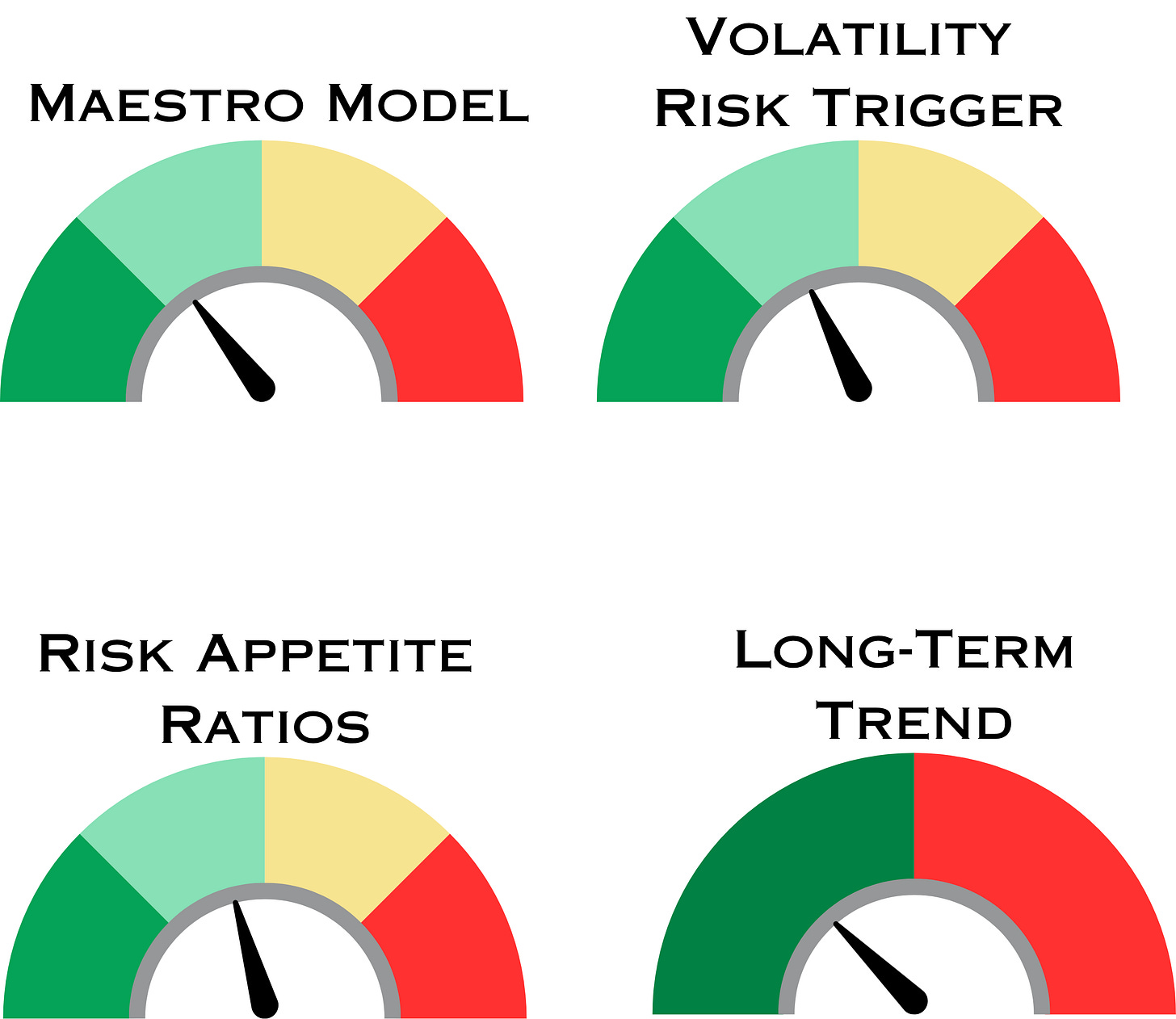

Summary of Models

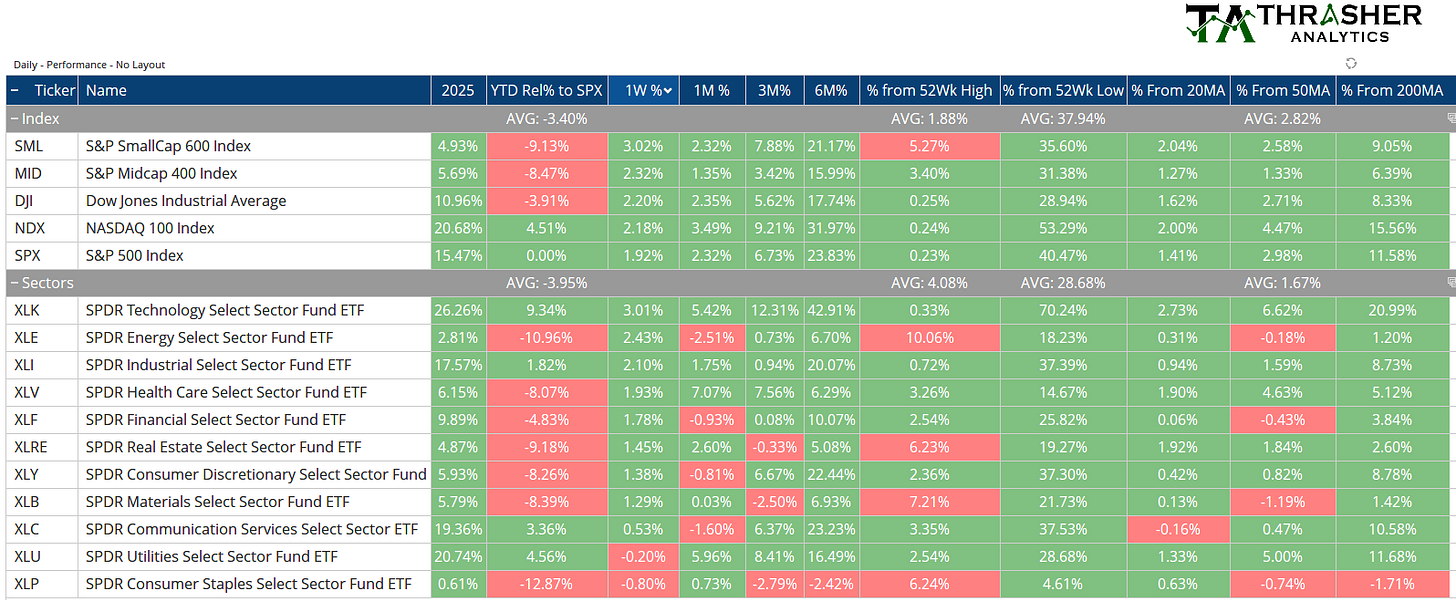

Index & Sector Performance Summary

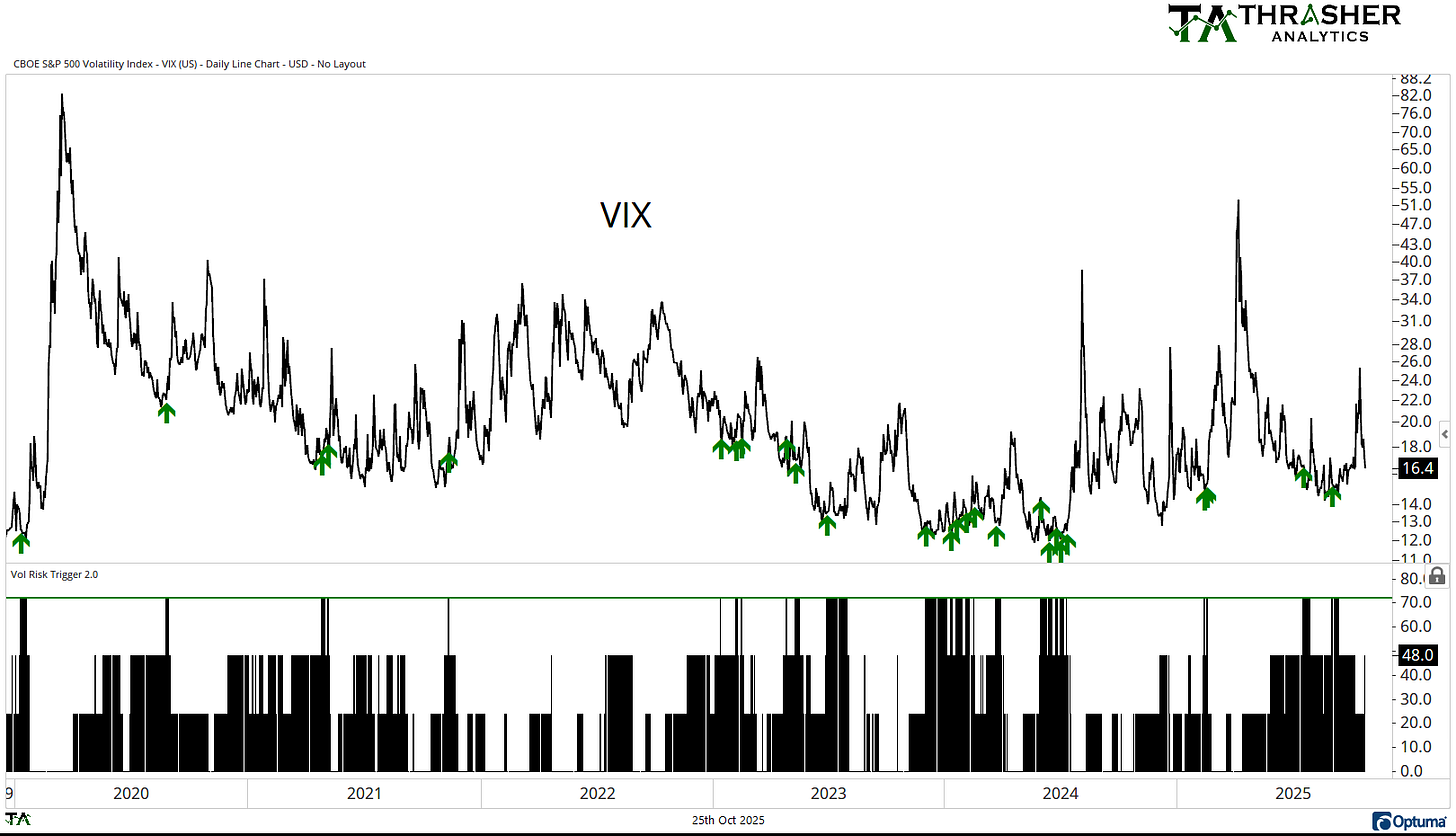

Volatility Risk Trigger

VRT has moved back up to 48 but the data is still fairly far from getting to levels of another spike signal.

Keep reading with a 7-day free trial

Subscribe to Thrasher Analytics to keep reading this post and get 7 days of free access to the full post archives.