Updated Models & Spotlight Charts 9/7/2025

New High in Gold, VIX Risk, and Equity Seasonality

The S&P 500 moved higher for the week, seeing a small pullback on Friday but still held above the 20-day moving average. Last week brought an important update to volatility (discussed later in the note). Divergences still exist in risk appetite and momentum, with the Maestro Model now also diverging (but still remaining positive). Financial markets will get a look at inflation data this week with CPI being reported. Which comes after softening employment numbers in August. There’s already a priced in rate cut for September but a growing crowd calling for additional cuts before year-end. FOMC is next week. This week’s spotlight charts look at the new high in gold and equity seasonality trends.

Summary of Models

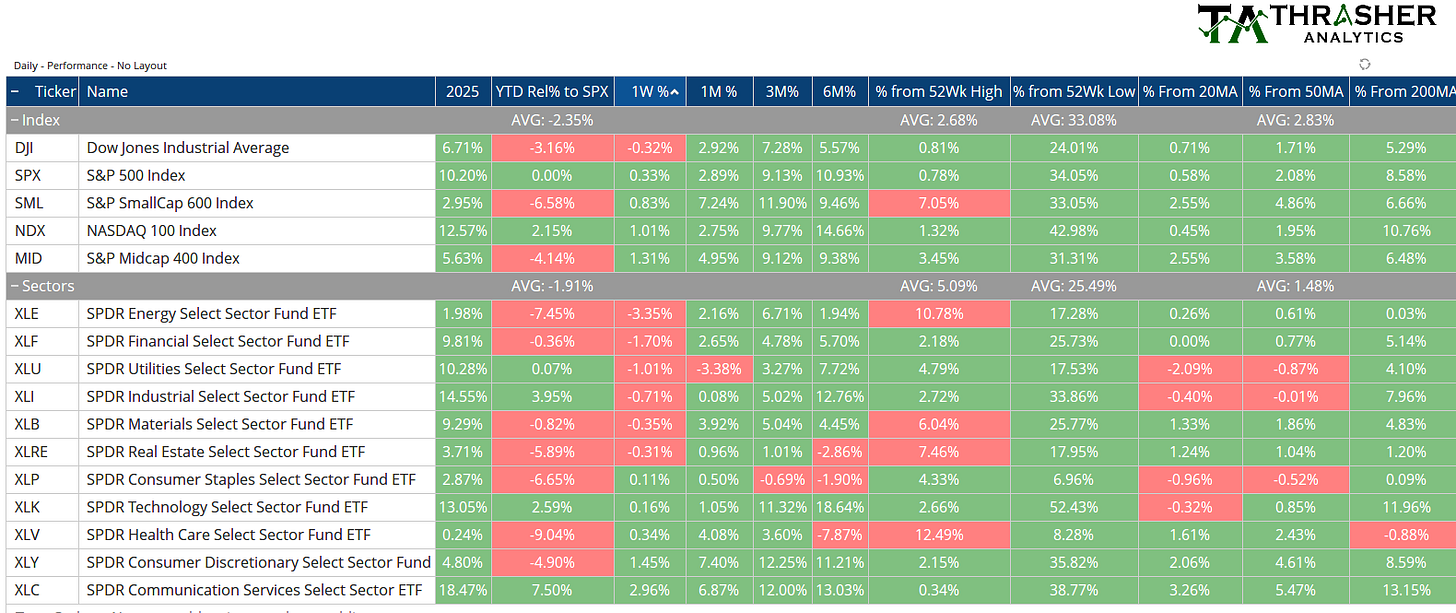

Index & Sector Performance Summary

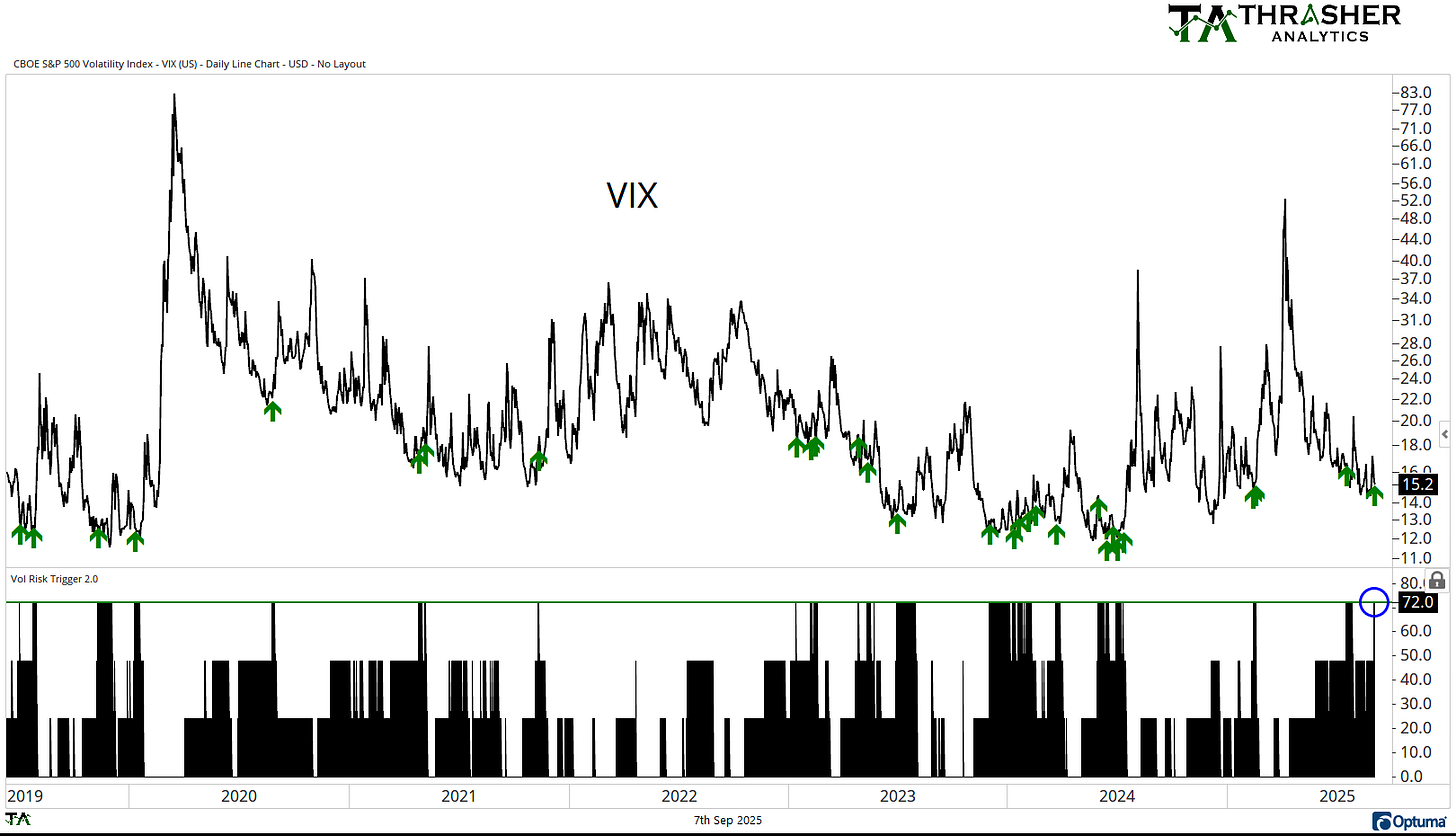

Volatility Risk Trigger

On Friday I sent out a special note about the VRT triggering, hitting 72. There is now a heightened risk of the VIX moving higher and potentially spiking.

Keep reading with a 7-day free trial

Subscribe to Thrasher Analytics to keep reading this post and get 7 days of free access to the full post archives.